As consumer demand for soft drinks continues to grow globally, regulatory bodies are stepping up their efforts to ensure product safety, transparency, and sustainability. These regulations are set to address health concerns, environmental impacts, and consumer rights, requiring manufacturers to adopt more stringent practices. From sugar content limitations to new packaging guidelines, the soft drinks industry is facing a host of regulatory changes that will reshape the landscape. In this article, we will explore the key upcoming regulations and trends that are set to impact the soft drinks sector.

Key Trends in the Soft Drinks Industry

-

Health and Wellness-Driven Innovation: With growing concerns about obesity, diabetes, and other health issues, consumers are increasingly demanding healthier alternatives. This trend is pushing the soft drinks industry to innovate with low-sugar, sugar-free, and functional beverages. Regulatory measures aimed at reducing sugar consumption are accelerating this shift, encouraging manufacturers to invest in new formulations and healthier product lines.

-

Environmental Sustainability and Packaging: As environmental issues become more urgent, regulators are focusing on packaging waste reduction and promoting sustainability. From the push for biodegradable packaging to more stringent recycling requirements, the soft drinks industry must respond to these pressures. Regulations are encouraging the use of recycled materials, reducing single-use plastics, and adopting more eco-friendly manufacturing processes.

-

Sugar Content and Sweetener Regulations: Governments worldwide are introducing regulations to limit sugar content in soft drinks. These regulations are aimed at tackling the global rise in non-communicable diseases linked to excessive sugar consumption. In response, the industry is shifting towards alternative sweeteners and offering more low-sugar or sugar-free options to comply with new laws and meet health-conscious consumer demands.

-

Transparency and Clear Labeling: Consumers are increasingly seeking transparency about the ingredients and nutritional value of the products they purchase. As a result, regulators are mandating clearer labeling of ingredients, nutritional content, and origin. These regulations will ensure that consumers can make informed choices about the beverages they consume, promoting accountability and trust within the soft drinks industry.

-

Digital Tools for Compliance: As regulatory requirements become more complex and widespread, companies are turning to digital tools and AI to streamline compliance processes. These technologies allow soft drink manufacturers to monitor regulations in real-time, manage documentation, and stay updated with global regulatory changes, ensuring timely compliance with all relevant laws.

Upcoming Regulations in the Beef Industry: Key Changes on the Horizon

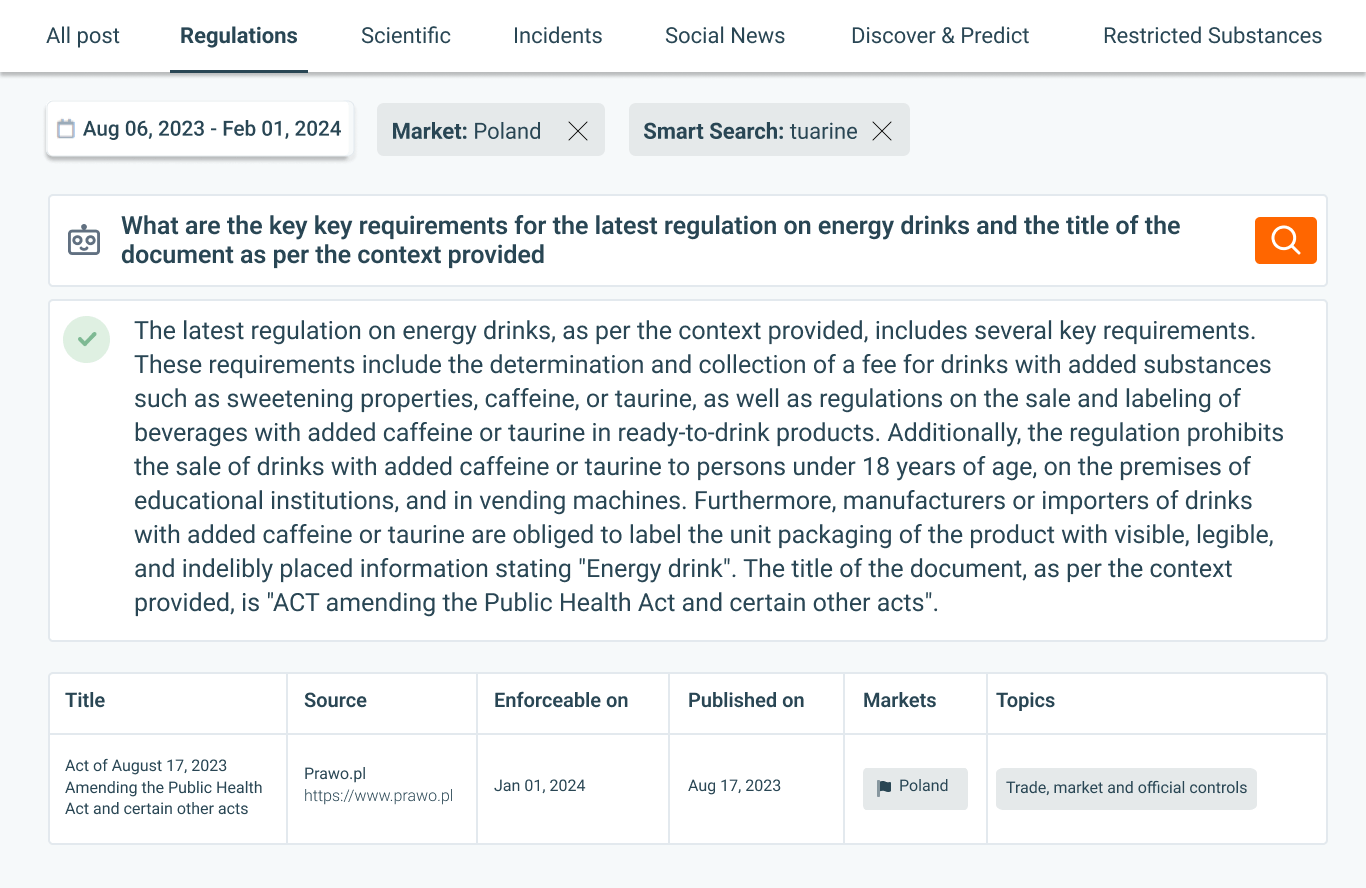

Using SGS Digicomply’s Regulatory Intelligence Hub, we will explore some of the key upcoming regulations in the soft drinks industry. Below, we provide an overview of significant regulatory changes that are expected to impact the industry and their potential implications for producers and distributors.

.png?width=570&height=311&name=Upcoming%20Soft%20Drink%20Regulations%20for%202024%20and%20Beyond_%20What%20to%20Expect%20(1).png)

1. Bill Status of SB2625 - Liquor-Display of Products (Illinois, USA)

Market: United States of America, Illinois

Published on: August 09, 2024

Enforceable Date: January 01, 2025

Source: Illinois General Assembly

Summary: SB2625 amends the Liquor Control Act of 1934 in Illinois, providing specific definitions and regulations for the display of alcohol-infused products and co-branded alcoholic beverages. It outlines the appropriate retail display settings, stipulating that these alcoholic items cannot be placed adjacent to non-alcoholic products that are attractive to children or contain youth-oriented imagery. The bill also mandates that retailers display clear signage to indicate that these products are alcoholic and are only available for purchase by individuals aged 21 and older.

Impact on the Soft Drinks Industry: For the soft drinks industry, this regulation may affect companies that produce or co-brand non-alcoholic beverages with alcoholic counterparts. It emphasizes the need for distinct product placement in retail environments to avoid proximity to non-alcoholic drinks, especially those targeted at children. Compliance will likely require adjustments in marketing strategies, store displays, and labeling practices. Retailers and producers will need to ensure clear demarcation and appropriate signage to avoid potential penalties.

Explore the current status, comprehensive dashboard with trends, and full text of regulations using the SGS Digicomply Regulatory Intelligence Hub. Check out the demo to see our regulatory compliance tools in action.

2.GOST 34975-2023 - Alcohol-Free Tonic Beverages: General Specifications (Russian Federation)

Market: Russian Federation

Published on: September 20, 2023

Enforceable Date: January 01, 2025

Source: Rosstandard

Summary: GOST 34975-2023 sets out the general specifications and technical conditions for the production of alcohol-free tonic beverages. The standard details the scope of application, normative references, terms, definitions, and classification criteria. It specifies the technical requirements, including raw material standards, acceptance rules, control methods, transportation, and storage. Additionally, it addresses appearance, physical and chemical properties, organoleptic characteristics, microbiological standards, and limits on toxic elements and food additives. The standard also incorporates guidelines for using tonic and biologically active substances, ensuring product safety and consistency.

Impact on the Soft Drinks Industry: Compliance with GOST 34975-2023 will require producers of alcohol-free tonic beverages in the Russian Federation to align their production practices with the new technical and safety standards. This may necessitate changes in sourcing raw materials, adjusting manufacturing processes, and enhancing quality control measures. Companies may need to invest in new testing protocols and training to ensure adherence to these specifications. While these requirements may increase operational costs, they will also help standardize product quality, potentially strengthening consumer trust and product marketability.

Explore the current status, comprehensive dashboard with trends, and full text of regulations using the SGS Digicomply Regulatory Intelligence Hub. Check out the demo to see our regulatory compliance tools in action.

3. 251/2024 Coll. - Act on the Tax on Sweetened Non-Alcoholic Beverages and Amendments to Certain Acts (Slovakia)

Market: Slovakia

Published on: October 05, 2024

Enforceable Date: January 01, 2025

Source: SLOV-LEX - Slovak Legal and Information Portal

Summary: The Act on the Tax on Sweetened Non-Alcoholic Beverages, enacted by the National Council of the Slovak Republic, introduces a taxation framework for sweetened beverages. It defines key terms, establishes tax liabilities, and sets the tax rates applicable to various types of non-alcoholic drinks containing added sweeteners. The law outlines administrative procedures, including taxpayer obligations for record-keeping and registration, methods for calculating tax, and provisions for tax refunds. Additionally, the act provides guidelines for collaboration between tax authorities and food control agencies to ensure proper enforcement. Transitional measures are included to help businesses adapt to the new tax system.

Impact on the Soft Drinks Industry: This tax law will likely increase the cost of producing and selling sweetened non-alcoholic beverages, prompting manufacturers to reconsider their product formulations and explore the use of lower-taxed or non-taxed sweeteners. Compliance with the new record-keeping and registration requirements may also lead to higher administrative costs. The act could drive market shifts toward healthier beverage options as producers look to mitigate the tax impact, aligning their products more closely with consumer trends toward reduced sugar intake.

Explore the current status, comprehensive dashboard with trends, and full text of regulations using the SGS Digicomply Regulatory Intelligence Hub. Check out the demo to see our regulatory compliance tools in action.

4. HJ 1360—2024 - Technical Specification for Pollution Control of Contaminated Salt Utilization and Disposal (China)

Market: China

Published on: April 01, 2025

Enforceable Date: April 01, 2025

Source: Ministry of Ecology and Environment of the People's Republic of China

Summary: HJ 1360—2024 is a technical specification established by the Ministry of Ecology and Environment of China that sets pollution control standards for the utilization and disposal of contaminated salt, particularly sodium chloride, from the pesticide industry. The specification provides detailed requirements for waste salt management, including collection, storage, transportation, treatment, and final disposal, with the aim of minimizing environmental impact and promoting ecological sustainability. It emphasizes reduction, resource utilization, and ensuring that waste disposal processes are harmless to the environment. The standard also includes pollution control measures, environmental monitoring protocols, and management practices for regulatory compliance.

Impact on the Soft Drinks Industry: While this standard primarily pertains to the pesticide industry, it underscores the growing emphasis on pollution control and sustainability practices that can influence cross-industry standards. For the soft drinks industry, this regulation highlights the importance of sustainable waste management and environmental practices. Companies involved in the supply chain, especially those sourcing additives or ingredients, may need to consider sustainable practices and ensure that their partners comply with evolving environmental standards to meet global sustainability expectations.

Explore the current status, comprehensive dashboard with trends, and full text of regulations using the SGS Digicomply Regulatory Intelligence Hub. Check out the demo to see our regulatory compliance tools in action.

5. Decree № 574 - Approval of Technical Regulations for the Exploitation and Marketing of Natural Mineral Waters (Georgia)

Market: Georgia

Published on: December 16, 2022

Enforceable Date: January 01, 2027

Source: Legislative Herald of Georgia

Summary: The Government of Georgia's Decree No. 574 sets technical regulations for the exploitation and marketing of natural mineral waters. Effective from January 1, 2027, these regulations cover the extraction, production, processing, and distribution of natural mineral waters, applying to both domestic and imported products. The decree specifies stringent conditions for bottling, labeling, and advertising practices, prohibiting misleading claims about the water's characteristics. It includes transitional provisions allowing existing products that do not meet the new standards to remain on the market until June 1, 2028. This decree also nullifies a 2014 regulation, aligning all current and future natural mineral water products with enhanced safety and quality standards.

Impact on the Soft Drinks Industry: This decree will require significant adjustments for producers and marketers of mineral waters in Georgia. Compliance will involve meeting stricter bottling and labeling standards, ensuring that all claims made in advertising are accurate and verifiable. Companies may need to upgrade processing facilities and review marketing materials to align with the new regulations. For businesses dealing with imports, adherence to these updated standards will be crucial to maintaining market access. The regulation reinforces transparency and quality in mineral water production, potentially increasing consumer confidence but also leading to higher compliance costs for producers.

Explore the current status, comprehensive dashboard with trends, and full text of regulations using the SGS Digicomply Regulatory Intelligence Hub. Check out the demo to see our regulatory compliance tools in action.

Conclusion

The soft drinks industry is facing a wave of regulatory changes that will significantly impact production, marketing, and sustainability practices. These regulations, ranging from sugar taxation and pollution control to stringent product labeling and packaging standards, are being implemented across various markets. While compliance may introduce operational and financial challenges, it also provides an opportunity for manufacturers to innovate, improve transparency, and align with consumer expectations for healthier and more sustainable products. Staying proactive and informed will be key for companies looking to adapt successfully and maintain their competitive edge.

Explore SGS Digicomply’s Regulatory Intelligence Hub

SGS Digicomply’s Regulatory Intelligence Hub offers a powerful solution for managing regulatory complexities across 150+ jurisdictions. With AI-driven research tools, easy-to-read regulatory guides, change monitoring, and an interactive agenda, the platform empowers teams to make informed, timely decisions. Whether you’re tracking new rules or comparing global standards, SGS Digicomply is your essential partner for proactive compliance. See how it works in our demo.

.webp?width=1644&height=1254&name=Food%20Safety%20Dashboard%201%20(1).webp)